Credit

Why is good credit important?

It is important for you as a consumer to make sure you have a good credit report. Your credit will be checked for a wide variety of reasons including for any type of loans, employment, insurance, credit cards, renting an apartment, or when signing up for utilities.

How does the new federal credit card legislation impact students? Go to www.campusgrotto.com/credit-card-act-new-rules-for-student-credit-cards.html for more information.

What is a credit score or a credit report?

- Credit Report - a detailed record of your credit history. Your credit report is maintained by companies known as credit reporting agencies or credit bureaus. Lenders and creditors can use your credit report to determine your risk as a borrower. For a Free Credit Report the official site is www.annualcreditreport.com where you are entitled to one credit report every 12 months from the three credit bureaus of TransUnion, Experian and Equifax. You only get the report free at this site, not your credit score. You can obtain your FICO credit score for a small fee at this site.

- Credit Score - a number representing an individual's creditworthiness based on their past and current credit files. A credit score is based on information typically sourced from credit bureaus. The range of credit scores for the FICO scoring method is from 300 to 850. The higher the score, the better your credit. High credit scores can help you qualify for loans at lower interest rate charges. For the best rates, your credit scores should be 720 or above.

- You can also use www.creditkarma.com to obtain a Free Credit Score, but first read their disclosures. Credit Karma shows your scores from Equifax and TransUnion, calculated using VantageScore 3.0 not the FICO score. However, it’s free and there’s no impact to your credit. On Credit Karma, you can also get your reports from Equifax and TransUnion for free. Your scores and reports can be updated weekly, which could help you spot signs of possible identity theft more quickly.

How can I establish credit if I do not have any?

If you understand how to manage credit wisely, then there are a few simple ways to begin to establish credit:

- Student loans are on your credit report so proper repayment is important.

- Learn more about the ins and outs of how credit works at Credit Card Insider.

- Talk to your bank or credit union about a credit card, or compare credit cards at www.nerdwallet.com, www.cardratings.com/cardrepfr.html, or www.bankrate.com/credit-cards.aspx.

- You may have to talk to your bank about a secured credit card with a bank account to back it up.

- Other types of loans such as auto loans may be an option.

By establishing a form of credit, and managing it wisely you can begin to show lenders you are responsible and trustworthy with credit. Tips for building a strong credit history are below.

How is my credit score determined?

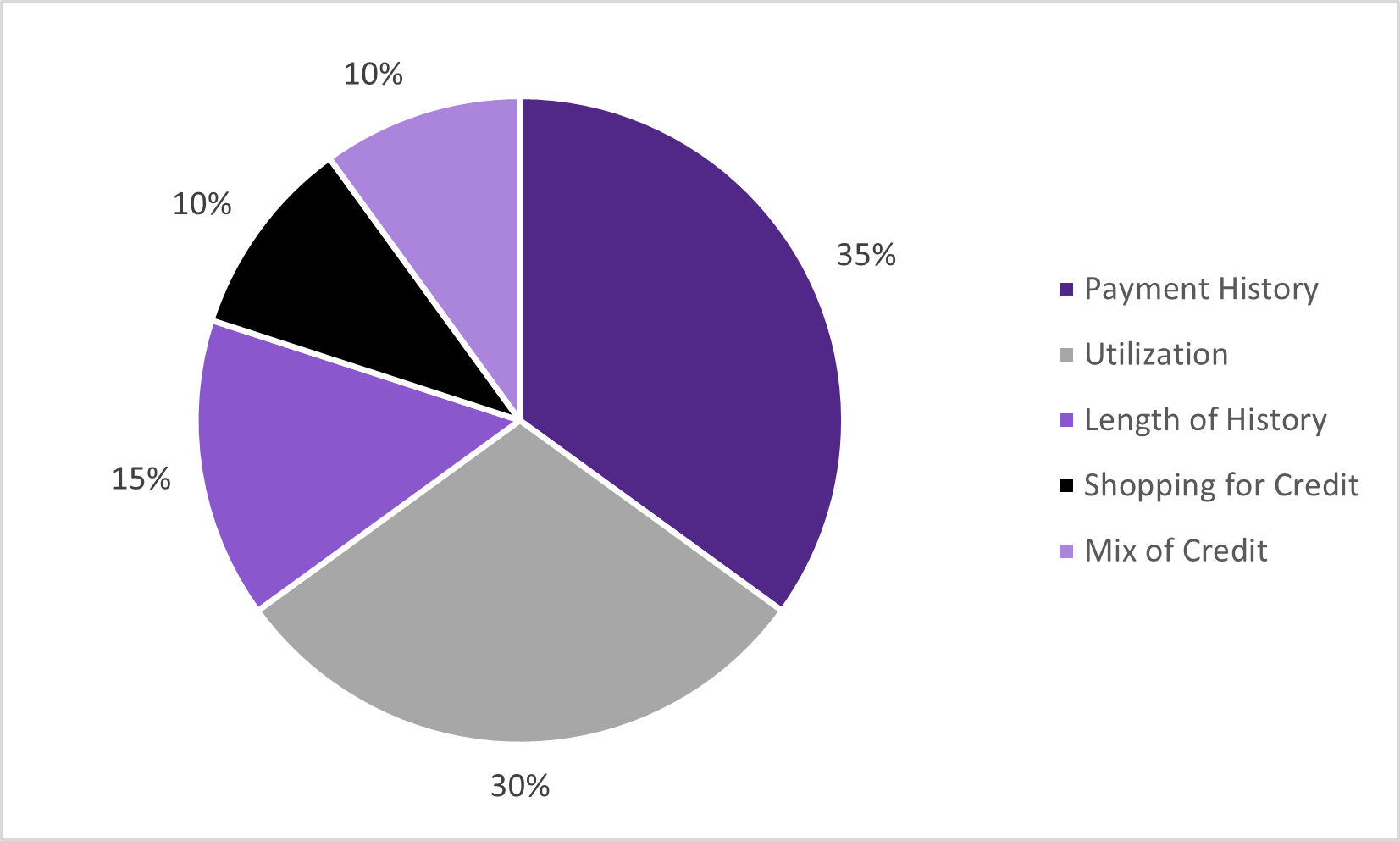

According to myFICO.com the information can be broken down into five categories.

- 35% is based on your payment history and whether you pay on time.

- 30% is based on the amount you owe compared to the credit you have available.

- 15% is made up of the length of your credit history, with longer relationships with creditors being viewed favorably.

- 10% rates how often you shop for credit and open new accounts.

- 10% is based on the kinds of credit you have with a mix of cards and loans being preferred.

How do I improve my current credit?

- Start by identifying key areas on your credit report that need attention. Make sure your credit report contains no incorrect information. Incorrect information should be reported immediately. By clearing up incorrect information, you may find your credit score will improve.

- Always pay your bills ON TIME!

- STOP using your credit card and accruing more debt. Pay off your credit card every month and do not carry any balances.

- Use credit sparingly - try to stay under 30% of your credit limit.

- Limit yourself to just a few major credit cards.

- Do not close long standing credit accounts as the longer you have a credit history the better it is for your credit. Maintain these accounts in good standing for a long period of time. Do not open accounts that will only be open for a short period of time.

Is there a way to stop receiving unsolicited credit card offers in the mail?

Visit www.ftc.gov/bcp/edu/pubs/consumer/credit/cre17.shtm to learn more about prescreening and how to stop receiving credit card offers for five years or permanently. This website also gives information about the National Do Not Call Registry which reduces telemarketing calls.

What if you're a victim of identity theft?

Identity theft happens when someone steals your personal information and uses it without your permission. Refer to the Federal Trade Commission site to learn how to protect your information or respond if it is stolen.